Using CMM for Trade History Reporting and Tax Accounting

By CMM Team - 16-Oct-2020

Recordkeeping is always a hassle, but CMM makes it easy.

Traders who use Coin Market Manager can no generate and download customized reports of their crypto trading history to use for tax filing and other general account purposes from inside their CMM dashboard.

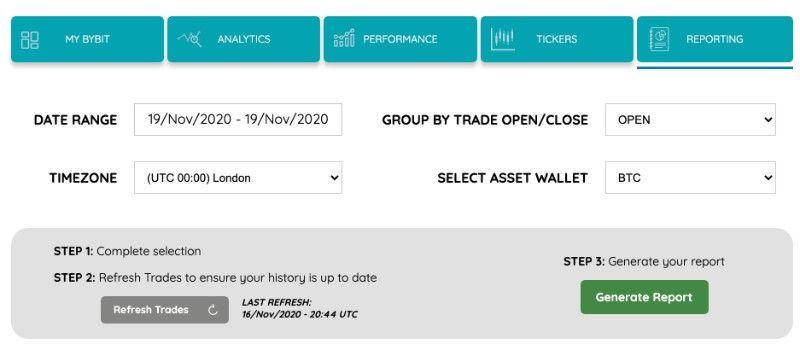

User-generated reports can be segregated by day and arranged in monthly blocks, including the number of trades taken, total trade volume, and profits and loses denominated in crypto and fiat currency. To create one of these neatly organized reports, select a custom date range, a time zone, and asset wallet, and organize by trade close or open.

See the image below for an example of using this tool.

Users should be sure to have actioned a full pull of their trading history. Refreshing the CMM dashboard to the latest trade data syncs to the account accomplishes this. Now the reporting tool can include the most recent data.

Once the above steps are completed, click the Generate Report button shown in the image below as an example.

Once generated, the report preview will offer users the opportunity to proof the data. Each report will be arranged by day and segmented by month. In a report, users will find a complete breakdown of the following types of data:

- USD PnL

- Crypto PnL

- Trade Count

- Trade Volume

- End-of-day Balance

- Deposit and / or Withdrawal Activity

After proof checking the report, click the Download CSV button.

Readers should note that reporting features are only available to enterprise users or can be accessed for free using CMM Unlocked. Eligible users can generate as many reports as the need (or want).